We are thankful for those who have made an estate gift to TCU. Here are their stories.

Free Estate Planning Tool

Join fellow TCU supporters on Giving Docs, a safe, secure and free-for-life suite of estate plan essentials.

Get Started

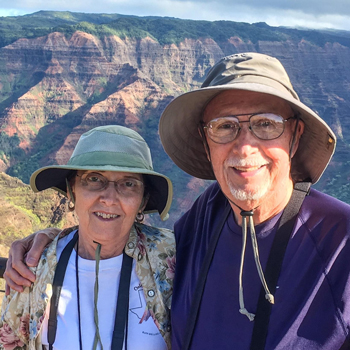

Providing the Means for a Happy, Successful Life

Despite the Roddeys’ inauspicious meeting, the bond that they formed 70 years ago has been as long-lasting as the attachment they have with their alma mater. That connection prompted them to make the university part of their estate plans.

Read More

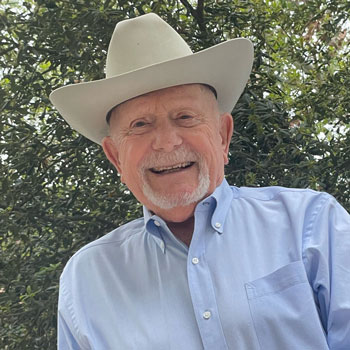

Saying 'Yes' to TCU

Dr. Phil Hartman, dean of TCU's College of Science & Engineering, has heard regularly from prospective students that TCU is their first choice, but they received better scholarships elsewhere. By endowing a scholarship of their own, Phil and his wife hope more students can pick TCU.

Read More

Providing Horned Frogs a Strong Foundation For Success

"Lucky Lindy" (Lynn D.) Segall '74 believes he and other Horned Frogs have an obligation to give back to the University because they have benefitted greatly from those who've gone before them. Another reason? "The joy we get from watching lives unfold after graduation, knowing we made a difference."

Read More

'Comrades True' Invest in TCU's Future

For Susan and James H. Carter III, "Mem'ries Sweet, Comrades True" is more than a phrase from their alma mater. TCU continues to play an active role in the lives of these Class of 1968 graduates, with Horned Frogs athletic events around the country giving the Connecticut couple opportunities to maintain lifelong friendships and rekindle old ones.

Read More

Helping Horned Frogs Find Their Place in the World

Many college freshmen face a challenging transition, but when Frances Reaves '76 came to TCU to study with renowned Ballet Director Fernando Schaffenburg, it was "pure culture shock." She had been living in Singapore because of her father's oil exploration career and had chosen TCU over SMU because of Schaffenburg's reputation.

Read More

Inspiring the Future With a Gift

Jane Strauss Northern '72 says study abroad experiences and inspirational TCU professors prompted her to establish a gift in her will that will help the University's liberal arts professors' travel and study to enhance their scholarship and teaching.

Read More

Taking An Artful Approach to Creating a TCU Legacy

Robert '54 and Mary Jane Howell Sunkel '55 believed personal experience was the most valuable form of education and accordingly traveled around the world to experience art, architecture and culture firsthand. Although deceased, the couple's vision and legacy continues through the Sunkel Art History Endowment.

Read More